CARBON MARKETS

- To battle climate change, countries around the world agreed to reduce greenhouse gas emissions (GHG) through the Kyoto Protocol of 1997 and Paris Agreement of 2015—treaties legally binding countries to specific carbon dioxide reduction goals

- Each country laid out its own emission reduction targets to meet those goals

- This has, in turn, forced businesses in each country to seek new ways of reducing their own carbon footprint

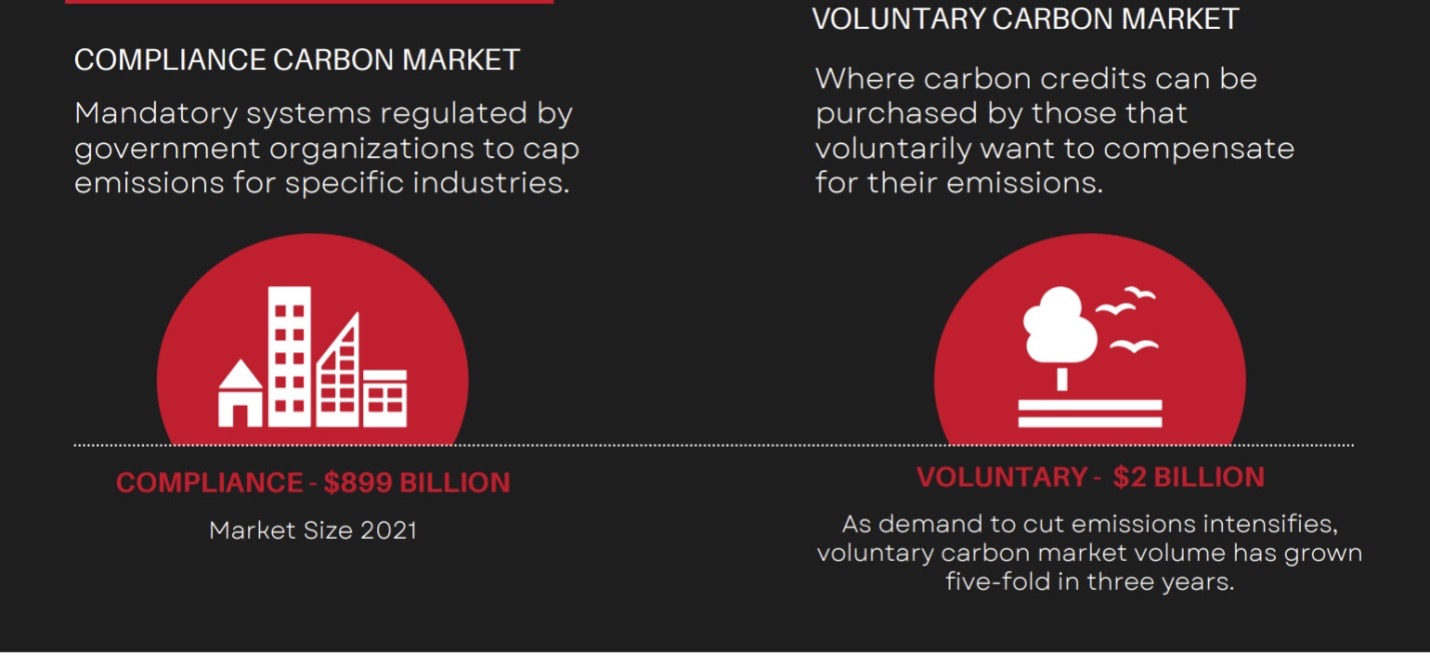

There are two types of CARBON MARKETS:

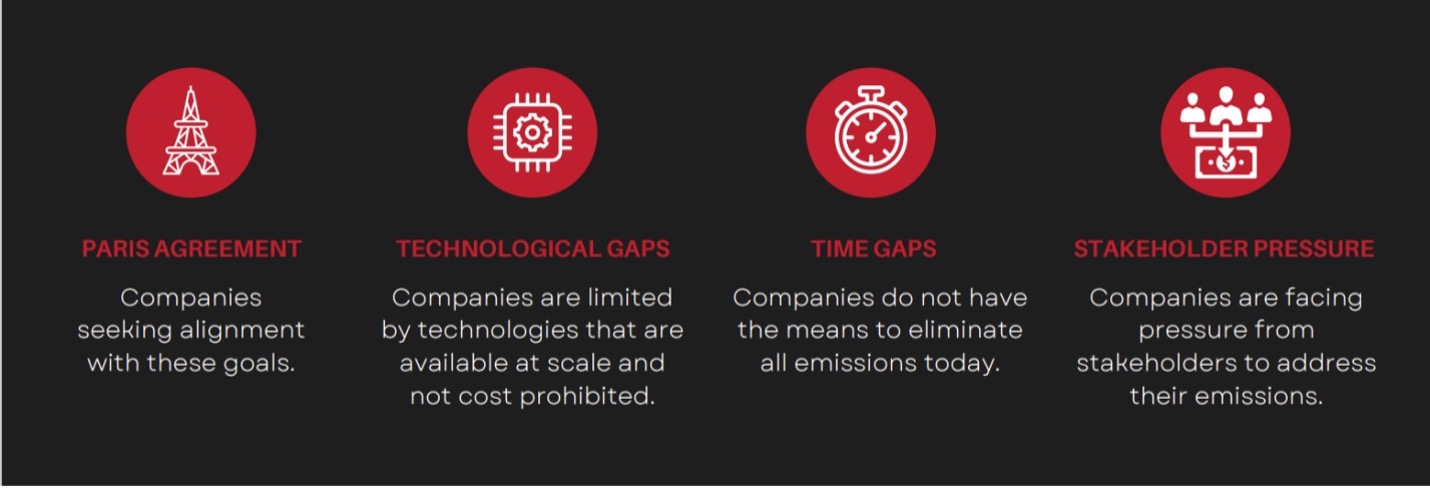

There is a Voluntary Market Demand because:

What qualifies as a WIN/INDIGENOUS CARBON ALLIANCE high quality carbon Credit?

How the WIN/INDIGENOUS CARBON ALLIANCE Program Works

Timeline for establishing Carbon Credits:

- Letter of Intent received and property documents uploaded

- Property ownership is verified with property viability assessment

- Property is surveyed and carbon contract executed

- Property Report is prepared ordering property imagery and by developing property API

- Carbon Credits are calculated and carbon credits are developed

- Carbon Credits can be deposited in bank or listed for sale

Once carbon credit status has been identified, INDIGENOUS CARBON ALLIANCE will create the “real” carbon credit report that is valuable. The Carbon Contract is executed. Property Imagery and Property API is added. The property owner has the option of selling the credits on the platform or storing the credits at the INDIGENOUS CARBON ALLIANCE Carbon Bank. When the land owner is ready to sell the credits, The INDIGENOUS CARBON ALLIANCE Carbon Bank will list them for sale.

In this process:

- INDIGENOUS CARBON ALLIANCE pays for the Land Owner Carbon Credit due diligence report

- Carbon Credits are issued on an annual basis, and

- The report is exclusively for the use of the landowner only (not a public document).